Feature

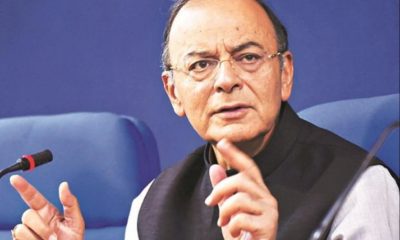

Jaitley urges India Inc to build public opinion for GST bill

New Delhi: A day after the government tabled the Goods and Services Tax (GST) Bill in the Lok Sabha, Finance Minister Arun Jaitley Saturday urged industries to build public opinion in states for passing the law on reforming India’s indirect tax system.

“Any state that does not fall in line (with GST), my advice to all stakeholders is go to states to raise the issue, to convin ce, to pressurise public opinion in all the states,” Jaitley said, addressing an event of the Federation of Indian Chambers of Commerce and Industry.

ce, to pressurise public opinion in all the states,” Jaitley said, addressing an event of the Federation of Indian Chambers of Commerce and Industry.

Hinting that complete consensus is awaited on a bill that needs to be passed by a two-third majority in both the houses of parliament and by the legislatures of half of the states to become a law, the finance minister called for “a shared national vision on basic issues”.

“Today, there is a clear choice before us, reform or miss the bus. It is literally a choice that the future generation is not going to pardon us if we miss the reform bus again,” Jaitley said, referring to the “strange convergence” of ideologically opposed parties in blocking reform measures, particularly in the Rajya Sabha.

The United Progressive Alliance (UPA) government had introduced a Constitution Amendment Bill in the Lok Sabha towards the introduction of the GST in 2011.

States sought a five-year compensation package and asked for its inclusion in the bill.

Jaitley introduced the bill in the lower house Friday, saying the objective of the legislation is “the seamless transfer of goods and services across the country”.

“The GST will be a win-win situation for both the states and the centre. The GST will be the single most important tax reform, with potential to convert the entire country into a single market and avoid taxation over taxation,” he said.

The bill, which will be taken up for discussion in the budget session of parliament in February, proposes a national sales tax that will replace a myriad of overlapping state duties that deter investment.

Jaitley said he had achieved a “near consensus” with the Empowered Committee of State Finance Ministers on GST in a meeting here.

“This is not a partisan legislation. We will ensure that the interest of every state is taken care of, that no state will lose a rupee of revenue,” Jaitley said.

GST reform would strengthen the principle of “co-operative federalism” as the central and state governments would need to work together to take decisions which would require 75 percent majority approval in the GST Council.

Jaitley told the house that states will receive Rs.11,000 crore this fiscal towards partial compensation of the losses suffered by them for reduction in central sales tax (CST).

While the CST is levied by the central government on inter-state movement of goods and collected by states, the issue of compensation arose because the central government cut the CST from 4 percent to 2 percent in phases, after state-level VAT was introduced from April 1, 2005.

Earlier, finance ministers of seven states in a meeting here Thursday rejected the draft Goods and Services Tax (GST) Bill, saying it does not address their concerns on the issues of compensation, entry tax, and the tax on petroleum products.

The states also want petroleum, alcohol and tobacco to be kept out of the purview of the GST.

Seen as a key to facilitate the industrial growth and improve the business climate in the country, the GST bill needs to be passed by a two-third majority in both the houses of parliament and by the legislatures of half of the states to become a law.

By subsuming most indirect taxes levied by the such as excise duty, service tax, VAT and sales tax, GST proposes to facilitate a common market across the country, leading to economies of scale and reducing inflation through an efficient supply chain.

Entertainment

Meghalaya Reserves Legalized Gambling and Sports Betting for Tourists

The State Scores Extra High on Gaming-Friendly Industry Index

Meghalaya scored 92.85 out of 100 possible points in a Gaming Industry Index and proved to be India’s most gaming-friendly state following its recent profound legislation changes over the field allowing land-based and online gaming, including games of chance, under a licensing regime.

The index by the UK India Business Council (UKIBC) uses a scale of 0 to 100 to measure the level of legalisation on gambling and betting achieved by a state based on the scores over a set of seven different games – lottery, horse racing, betting on sports, poker, rummy, casino and fantasy sports

Starting from February last year, Meghalaya became the third state in India’s northeast to legalise gambling and betting after Sikkim and Nagaland. After consultations with the UKIBC, the state proceeded with the adoption of the Meghalaya Regulation of Gaming Act, 2021 and the nullification of the Meghalaya Prevention of Gambling Act, 1970. Subsequently in December, the Meghalaya Regulation of Gaming Rules, 2021 were notified and came into force.

All for the Tourists

The move to legalise and license various forms of offline and online betting and gambling in Meghalaya is aimed at boosting tourism and creating jobs, and altogether raising taxation revenues for the northeastern state. At the same time, the opportunities to bet and gamble legally will be reserved only for tourists and visitors.

“We came out with a Gaming Act and subsequently framed the Regulation of Gaming Rules, 2021. The government will accordingly issue licenses to operate games of skill and chance, both online and offline,” said James P. K. Sangma, Meghalaya State Law and Taxation Minister speaking in the capital city of Shillong. “But the legalized gambling and gaming will only be for tourists and not residents of Meghalaya,” he continued.

To be allowed to play, tourists and people visiting the state for work or business purposes will have to prove their non-resident status by presenting appropriate documents, in a process similar to a bank KYC (Know Your Customer) procedure.

Meghalaya Reaches Out to a Vast Market

With 140 millions of people in India estimated to bet regularly on sports, and a total of 370 million desi bettors around prominent sporting events, as per data from one of the latest reports by Esse N Videri, Meghalaya is set to reach out and take a piece of a vast market.

Estimates on the financial value of India’s sports betting market, combined across all types of offline channels and online sports and cricket predictions and betting platforms, speak about amounts between $130 and $150 billion (roughly between ₹9.7 and ₹11.5 lakh crore).

Andhra Pradesh, Telangana and Delhi are shown to deliver the highest number of bettors and Meghalaya can count on substantial tourists flow from their betting circles. The sports betting communities of Karnataka, Maharashtra, Uttar Pradesh and Haryana are also not to be underestimated.

Among the sports, cricket is most popular, registering 68 percent of the total bet count analyzed by Esse N Videri. Football takes second position with 11 percent of the bets, followed by betting on FIFA at 7 percent and on eCricket at 5 percent. The last position in the Top 5 of popular sports for betting in India is taken by tennis with 3 percent of the bet count.

Local Citizens will Still have Their Teer Betting

Meghalaya residents will still be permitted to participate in teer betting over arrow-shooting results. Teer is a traditional method of gambling, somewhat similar to a lottery draw, and held under the rules of the Meghalaya Regulation of the Game of Arrow Shooting and the Sale of Teer Tickets Act, 2018.

Teer includes bettors wagering on the number of arrows that reach the target which is placed about 50 meters away from a team of 20 archers positioned in a semicircle.

The archers shoot volleys of arrows at the target for ten minutes, and players place their bets choosing a number between 0 and 99 trying to guess the last two digits of the number of arrows that successfully pierce the target.

If, for example, the number of hits is 256, anyone who has bet on 56 wins an amount eight times bigger than their wager.